When forming your own company, you have a lot of decisions to make. One of…

10 Items You Must Have in Your Startup’s Budget

Starting a business is hard, especially if you’re starting out on your own. You have many things to consider: Will my business succeed? What’s my business model and strategy? Will I sell enough of my product or services to make a living? How will I find and keep customers?

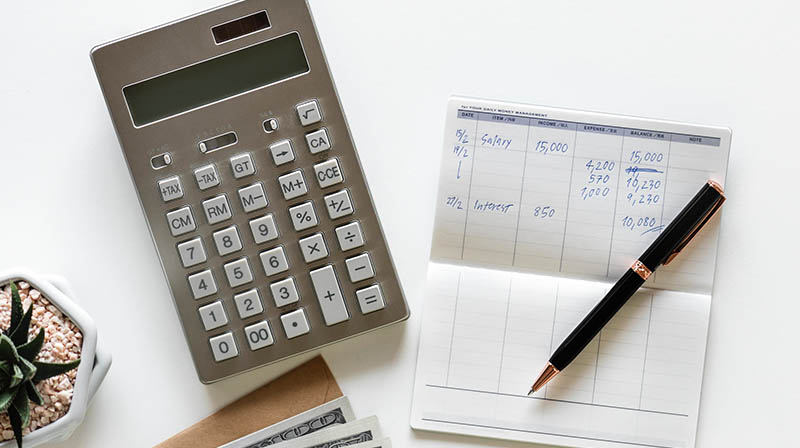

Add to the fact that you’ll have your own expenses in starting the business, and you’ve got the potential for a financial mess. Marketing and advertising will help you sell your product or service, and good customer service will help you keep those customers. But you have to keep costs down. That’s why having a budget – and keeping to it – is so important.

A budget, just like one for your home, guarantees that each cent is accounted for, and that you aren’t spending money on frivolous items. The first few years of starting a business are the toughest: One in six businesses closes its doors during the first four to five years.

So what should you be spending your money on? Depending on your business, the list could be short. For example, if you’re a staff of one, you don’t need to worry about salaries, pensions, healthcare or FICA. If you work from home, you don’t have to worry about paying rent for office space. But there are other items you need to think about:

- Professional fees. You may need to file special papers with the county or state related to your business; an accountant or an attorney can help you gather the paperwork you need and advise you on how you should form your business. Do you need any special insurance for your business? Take into account the premiums for your policies. And those filings with the government will cost money as well.

- Equipment. You may need money for computers, printers, desks, chairs and filing cabinets. Luckily, a lot of this may be tax deductible, but your accountant can help you find out what’s deductible.

- Raw materials. Does your business involve the creation or manipulation of materials that you’ll need to buy – for example, ingredients and cookware for a bakery, or paint supplies for a painting service? Write it all down.

- Office materials/printing/postage. These may seem like small items, but staplers, paper, printer ink and stamps add up over a year.

- Travel. Do you have to travel for your job? Figure in money for plane tickets, automobile mileage and meals. You may even need to buy a car or van to help you with your business.

- Training/memberships. Looking legitimate fosters confidence in potential customers. Make sure you are a member of the professional associations that are linked to your business; join the local Chamber of Commerce, and get trained and certified in your field. These items come with costs; put them in your budget

- Consulting/professional services. Every once in a while you may need something that’s out of your comfort zone – logo design, contract help, long-term strategic planning. Find out what services you’ll need to keep your business growing. Companies such as Fiverr and Upwork may help you find a budget for this.

- Marketing/advertising. As mentioned earlier, you must have a marketing plan, and depending on the activities associated with that plan, you may have to pay for advertising, marketing materials, website and direct mail.

- Telephone. Luckily, we have this one covered for you, but budget for it anyway. Ninja Number’s rates start at $9.95 a month, depending on how often you use your phone and how many lines or extensions you need.

- Miscellaneous expenses. Who knows what may appear in this category? An office party? Gifts for your customers? Don’t put too much money in this category – you don’t want it to be a slush fund – but it’s good to have a set amount of money that you can dip into when you need it most – like an emergency fund.

Try to get as detailed as possible, thinking of every scenario, then stick to it. Your bottom line depends on it and ultimately will help determine if your company is successful. Use programs such as Mint or QuickBooks to keep track of your spending and income so you know whether you’re staying in the black.

Starting at just $9.95 a month!

LIFE IS CALLING. ALWAYS ANSWER.

Try Ninja Number free for 7 days. Instant activation – no contracts, and all features included!

We guarantee that Ninja Number will help grow your business. If you don’t believe Ninja Number can help grow your business and make more money, just cancel your service and that month’s payment is on us!!